Business News

Latest business news and updates

Total: 749

China’s Auto Industry Goes Global: Gigafactories, Subsidies and New Market Access Propel an Overseas Push

Chinese automakers and suppliers have accelerated overseas investment, disclosing more than RMB70 billion in projects over three months. Major moves include a planned 2.067 billion euro battery gigafactory in Portugal and policy openings in the EU, Canada and Germany, signaling a shift from export‑led sales to localised, global supply chain building.

Li Auto Tightens Its Retail Network as Growth Slows — From Rapid Expansion to Efficiency Drive

Li Auto is assessing the closure of some low‑efficiency retail stores after an aggressive multi‑year network build‑out, denying plans to close 100 outlets but confirming a targeted optimisation. The retrenchment follows a 19% fall in 2025 deliveries and recent quarterly losses, and accompanies a product and organisational reset aimed at restoring growth and margins amid fiercer competition in the range‑extended EV segment.

Market Ripples and Social Controls: China’s Gold Surge, Tencent’s Big Red Packet and a Gansu Quake Shake the Week

A 5.5-magnitude quake rattled Gansu but caused no confirmed casualties as emergency teams responded. China tightened internet protections for minors, markets saw a gold-led rally while mainland turnover topped 3 trillion yuan, Tencent plans a 1 billion yuan red-packet campaign for its new app, and KFC raised delivery prices slightly amid cost pressure.

Chinese Molecular‑Diagnostics Firm Faces Legal Blow as Controlling Siblings Indicted for Fraud

Rui'ang Gene, a Shanghai‑listed molecular diagnostics company, announced that its controlling siblings, former chair Xiong Hui and controller Xiong Jun, have been indicted on fraud charges. The company forecast a sizeable revenue drop and a net loss for 2025, while stressing that management and operations remain in place despite the criminal proceedings.

China CRO Pumps Profits by Stockpiling Lab Monkeys and Cash — but Sustainability Is in Doubt

Zhaoyan New Drug posted a paradoxical 2025 outlook: lower revenue but sharply higher net profit driven mainly by fair‑value gains on biological assets — chiefly experimental monkeys — and returns from cash management. The company’s core laboratory services remain under pressure, and the profitability bump has prompted scrutiny about the sustainability of relying on asset revaluation and financial income rather than scientific capabilities.

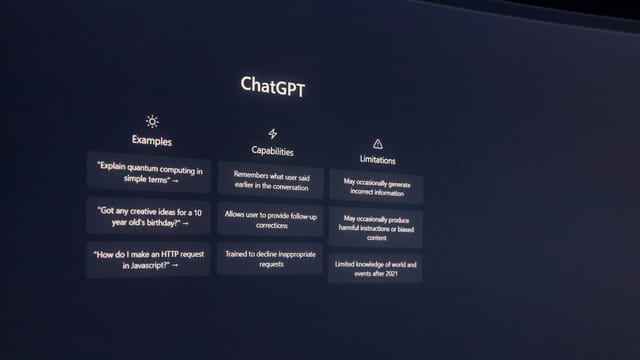

OpenAI Tests High‑End Ads for ChatGPT — Premium Prices, TV‑Style Reporting, But Sparse Measurement

OpenAI has started selling ads in ChatGPT at premium rates comparable to high‑value broadcast inventory, offering only basic impressions and click totals to early advertisers. The company plans to develop more advanced measurement tools over time, but the current lack of granular attribution and conversion reporting limits appeal to performance‑driven buyers and poses a hurdle for competing with established ad platforms.

Guangdong Hits RMB14.58tn — China’s Economic Engine Consolidates Lead and Eyes California

Guangdong posted RMB14.58 trillion in GDP for 2025, holding the title of China’s largest provincial economy for the 37th year. The province couples deep manufacturing capacity with leading-edge innovation, aims to double its economy by 2035, and plays an outsized role in national fiscal transfers and global trade.

China Purges Financial Influencers After ¥83m Penalty Exposes Social‑Media Stock Racket

Chinese regulators and major tech platforms have moved to punish and deplatform influential stock‑picking social media accounts after a high‑profile ¥83 million penalty exposed systematic manipulation. The coordinated action targets a wider problem: monetised investment communities and celebrity traders whose recommendations materially sway prices and leave retail investors exposed.

A Rare Step: U.S. and Japan Signal Joint Action to Stop the Yen’s Slide — Why Markets Are on Alert

Japan’s struggle between a collapsing yen and fragile government bond market prompted an unusually visible New York Fed ‘rate check’ at the U.S. Treasury’s direction, a signal markets read as readiness for coordinated U.S.-Japan intervention. The episode highlights Tokyo’s dilemma and could reshape dollar dynamics, Treasury demand and regional risk sentiment if followed by real onshore action.

China to Open Service Sectors, Launch Overseas One‑Stop Platform and Promote Digital Trade in 2026 Push for Market Expansion

China’s Ministry of Commerce has announced a service‑focused opening for 2026 that includes pilot liberalisation of telecoms, healthcare and education, a national one‑stop overseas platform for outbound firms, and a push to build a national digital trade demonstration zone with interoperable standards. The package aims to attract foreign investment, deepen digital trade, and leverage China’s large domestic market while advancing multilateral engagement at the WTO.

China Rare Earths Foresees Return to Profit as Price Swings Pinch Q4 Gains

China Rare Earths forecasts a net profit of RMB 143–185 million for 2025, reversing a RMB 287 million loss the prior year. The recovery was driven by a stronger first-half market and inventory write-backs, but fourth-quarter price falls in medium and heavy rare-earths triggered additional impairment charges that tempered full-year gains.

Moutai Cools the Speculative Bubble: Zodiac “Horse” Release Signals Shift from Investment to Consumption

Moutai’s latest zodiac release, the Horse-year “Ma-Mao,” has seen resale premiums shrink and dealer enthusiasm cool after the company introduced lower-priced and higher-quality dual versions and tightened release controls. The move reflects a deliberate strategy to reposition zodiac bottles from speculative assets toward consumer and collectible products, stabilising prices and emphasising cultural and drinking value.